Outsourcing Consulting News

Online Lead Generation System for Mortgage Lenders, USA

Customer Business Needs

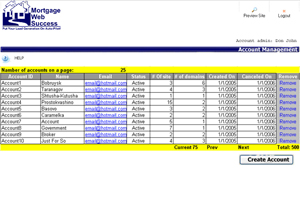

The Mortgage Web Success Managed Web System is designed to be an all in one online lead generation system for mortgage lenders. The focus of the system is automating the entire process of setting up a web site with a direct response marketing approach.

The automation process includes the following:

Web site creation using template from mortgage broker content

Sub domain access to the site at http://siteid.clientPortal.com

Wildcard secure certificate to allow each site to have a secure application on the sub domain

Allows site to have n domains pointed to it

Provides access to fully customize content of the sites through a content management system (CMS)

The site will have mortgage reports available for free that a visitor can request through a form on the site

The report requests are saved as leads in the client relationship management system (CRM)

The CRM automatically follows up with those leads via the default follow up message series that is created with template content with the site

The sites feature a secure application on the sub domain. Each message in the follow up series directs the lead to go back to the site application and complete that.

Application data is stored for mortgage broker to access through the control panel

Notification emails can be sent to mortgage brokers when reports have been requested and when an application is submitted through the site

Solution

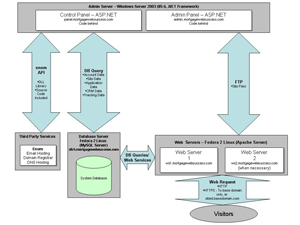

The developed version of the system included design changes to the backend of the system. This included redundant web servers and redundant dedicated database servers. The front end of the system including the Control Panel and the Web Portal remained unchanged from the member's point of view. Some integration was required to make the migration over to the new back-end. This involved writing some new code for the Control Panel which existed as an ASP.NET Application.

The point of having the multiple web server capability was that when the existing server load reached its full capacity and the performance of the sites began to be negatively affected, an additional web server could be added to the system by setting it up with the necessary system files to run the web site and add it as another server to the publishing system.

The final delivered system could be divided in the following modules:

- Service application to handle all periodic tasks in shadow mode (scheduler, auto responder);

- Kernel is a set of algorithms to perform common tasks (POP3 - SMTP client, wrapper around ENOM API, wrapper around BILL Thru API, UI components, classes for DB access);

- Set of customers template pages;

- Admin panel;

- Users control panel;

- Set of PHP scripts to control customers sites, configure Apache server, interoperate with kernel's code, DB access;

- Knowledge base entity representation classes.

Service application was a C# module that needed to be implemented as a base Microsoft Windows Service application and work on a server as a cron job to handle periodic tasks:

- Runs scheduler;

- Check up customers emails and act like auto responder.

Kernel is a set of binary modules and scripts to perform base functionality; it will consist of the following modules:

- Module for communication to Enom API;

- Module for communication to BillThru API;

- UI components;

- POP3-SMTP client.

Benefits

The current brain trust of Mortgage Success LLC had core domain expertise in high level systems architecture, and was looking for outsourcing partners to address specific technical challenges just as designing back end databases that could scale appropriately.

By outsourcing system development to SoloSoft the client reached the following:

- Maintained focus on high level systems architecture

- Reduced risk that product launch would be delayed

- Improved the overall quality of development

- Minimized development and maintenance costs.

Tools and Technologies

Microsoft Windows Server 2003 and Linux Fedora 2, MySQL, .NET Framework 1.1 SP1, C#, ASP.NET, PHP, Microsoft Visual Studio 2005.